The market of day trading is a volatile realm where fortunes can be made in the blink of an instant. To truly thrive in this demanding world, you need to understand the secrets that drive scalping. This isn't just about probability; it's a art honed through practice. A successful scalper possesses an unwavering focus, laser-like accuracy, and the skill to read the market like a book.

- Mastering price action is your cornerstone. Learn to identify patterns that indicate impending moves

- Technical indicators can reveal hidden opportunities. Explore graphs and their interpretations

Don't just trade; plan with control. Set clear objectives and stick to your plan even when the market challenges you.

Day Trade Like a Pro: Strategies for Consistent Wins

To become a day trader that consistently racks up wins, you need to implement powerful trading methods. It's not just about luck or gut intuition. You must develop a calculated approach that leverages market movements and protective measures techniques.

- Dive deep into market research

- Pinpoint winning entries

- Leverage charting tools

Remember, day trading can be rewarding, but it also carries inherent volatility. By mastering these strategies and staying informed, you can increase your chances of success in the dynamic world of day trading.

Unlocking the Market's Potential: A Beginner's Guide to Day Trading

Day investing can seem like a daunting venture, but with the right knowledge, it has the potential to be a profitable opportunity. This beginner's guide will explore the basics of day trading, empowering you to conquer the financial landscape with assurance.

- First, consider grasping the nature of day trading. It entails buying and selling assets within a day's timeframe, aiming to exploit short-term fluctuation movements.

- , Subsequently, is crucial to hone a sound investing strategy. This requires selecting appropriate assets, establishing reasonable goals, and executing controls.

- Ultimately, hands-on is indispensable. Begin with a simulated speculation platform to hone your skills without jeopardizing your assets.

Bear in mind that day trading can be substantial gains and risks. It's crucial to venture into it with caution, continuously enhancing yourself, and managing your vulnerability.

Technical Analysis Mastery

Unleash the potential of technical analysis and become a skilled day trader by mastering chart patterns. These visual representations of price action display valuable insights into market trends and momentum. By spotting common formations like head and shoulders, double tops and bottoms, and triangles, you can foresee potential price swings and make strategic trading decisions. A solid understanding of chart patterns empowers you to execute the volatile world of day trading with confidence.

- Hone your ability to analyze price action through charting.

- Comprehend key chart patterns and their meanings.

- Apply technical analysis tools to validate your trading strategies.

Conquering Volatility: Risk Management in Day Trading

Day trading can be an exhilarating journey, but its inherent volatility presents a constant challenge. Successful day traders understand that managing risk is paramount. They implement methods to minimize potential losses and safeguard their capital. A key component of this process involves establishing strict limit orders. These orders immediately sell a position when the price falls to a predetermined level, reducing potential losses.

Moreover, diversifying across assets can help spread risk. By not concentrating on a single security, traders can reduce the impact of any single market movement.

Mastering the Mental Game of Day Trading: Discipline and Focus

Day trading can be a thrilling yet daunting profession. It demands not only a deep understanding of financial markets but also unwavering focus to thrive. Emotions can run high as traders interpret charts, seeking patterns website and predicting price movements. However, letting emotions control your trading decisions is a surefire route to disaster.

The key to long-term success in day trading lies in cultivating a disciplined approach. This means adhering to your pre-determined trading plan, regardless of market fluctuations. It also involves the ability to suppress impulsive reactions and execute calculated decisions based on analysis.

By mastering your psychological attributes, you can navigate the volatile world of day trading with greater self-belief. Remember, a disciplined mind is a powerful tool in any trader's arsenal.

Rider Strong Then & Now!

Rider Strong Then & Now! Michael C. Maronna Then & Now!

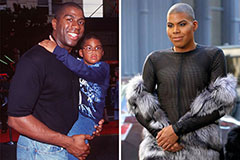

Michael C. Maronna Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!